The end game of global leveraged debt – double-digit percentage point market declines in Europe and Japan and the danger of refinancing debt with longer term debt.

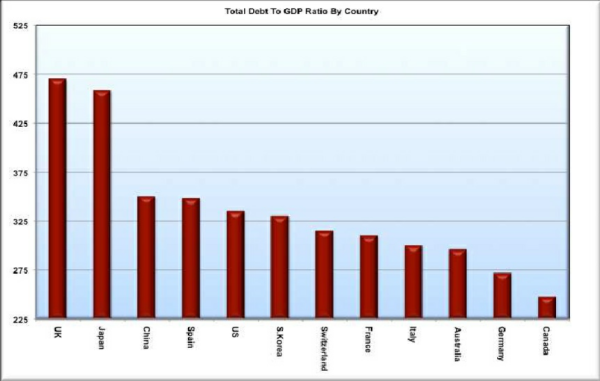

There is a painful realization that shifting debt around like a game of musical chairs has little merit unless real production is achieved as an end result. May was a disappointing month for markets in general. While the S&P 500 certainly fell, markets in Japan and Europe took double-digit declines. The massive amount of leverage and debt is simply being shifted around via Long Term Refinancing Operations (LTROs) in Europe. The market has little faith in this since a day of reckoning is hard to avoid even though large financial institutions seem to think they can shift away risk via fancy algorithms. To the contrary, these formulas have perfected a system that is simply dismantling the US middle class. A financial crisis built on debt is trying to find a solution in higher levels of debt via these same institutions.European Banking If you take a look at the European banking index you realize that they are in full meltdown mode: The Euro Stoxx Banking Index is down over 50 percent in less than one year. The fear of contagion is spreading as people pull deposits from countries like Spain and Greece and shift them elsewhere. People need only look at their own balance sheets to realize that very little economic benefit has occurred in this so called recovery. Many countries in Europe are back in recession, again. Here in the US, we have a record 46,000,000 Americans on food stampsand the unemployment figures keep dropping as people simply drop off the employment statistics figures. Make no mistake that the crisis in Europe is all about debt. In Greece, you have massive government debt backed by very little GDP and big outside banking bets. In Spain, you have giant amounts of debt backed by inflated real estate. The story sounds familiar because it is a path that we know all too well. Every region has a differing flavor but all these massive bubbles are sprouting up like weeds because of our debt based banking system. Debt to GDP Many countries are dealing with massive debt to GDP levels: Spending more than is being taken in can work in moderation. The fact that total global debt now is up to $190 trillion is incredible. Here is one sobering fact: “The amount of current global debt will never be repaid.”This is an axiom that is being realized by many across the world. Read the rest at My Budget 360 |

Saturday, June 2, 2012

GLOBAL ECONOMY IS A 'MELTDOWN MODE'

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment