Submitted by: Donald Hank

The essence of debt serfdom is debt rises to compensate for stagnant wages.

I often speak of debt serfdom; here it is, captured in a single chart. The basic dynamics are all here, if you read between the lines:

1. Financialization of the U.S. and global economies diverts income to capital and those benefitting from globalization/ “financial innovation;” income for the top 5% rises spectacularly in real terms even as wages stagnate or decline for the bottom 80%.

2. Previously middle class households (or those who perceive themselves as middle class) compensate for stagnating incomes and rising costs by borrowing money: credit cards, auto loans, student loans, etc. In effect, debt is substituted for income.

3. The dot-com/Internet boom boosted incomes across the board, enabling the bottom 95% to deleverage some of the debt.

4. When the investment/speculation bubble popped, incomes again declined, and households borrowed heavily against their primary asset, the home, via home equity lines of credit (HELOCs), second mortgages, etc.

5. The incomes of the top 5% rose enough that these households could actually reduce their debt (deleverage) even before the housing bubble popped.

Here is a chart of real (inflation-adjusted) incomes, courtesy of analyst Doug Short: note that the incomes of the bottom 80% have been flatlined for decades, while the top 20% saw modest growth that vanished once the housing bubble popped. Only the top 5% experienced significant expansion of income. Notice that incomes of the top 20% and top 5% really took off in 1982, once financialization became the dominant force in the economy.

Interestingly, we can see the double-bubble (dot-com and housing) clearly in the top income brackets, as these speculative bubbles boosted capital gains and speculation-based income. Since the bottom 80% had little capital to play with, the twin bubbles barely registered in their incomes.

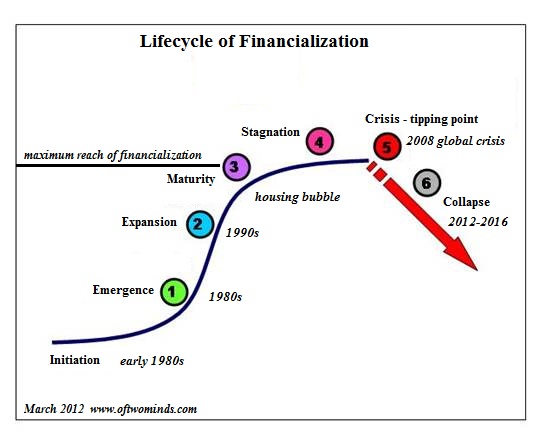

Bottom line: financialization and substituting debt for income have run their course. They’re not coming back, no matter how hard the Federal Reserve pushes on the string. Both of these interwined trends have traced S-curves and are now in terminal decline:

Those hoping the economy is “recovering” on the backs of financial speculation/ legerdemain and ramped up borrowing by the lower 95% will be profoundly disappointed when reality trumps fantasy.

|

No comments:

Post a Comment